| As at and for the year ended 31 December | Consolidated | ||||

| 2020 | 2019 | 2018 (Restated) |

2017 | 2016 | |

| Operating Performance (Million Baht) | |||||

| Interest Income | 4,213 | 4,339 | 4,074 | 44,681 | 45,208 |

| Interest Expenses | 1,620 | 1,599 | 1,515 | 15,511 | 16,740 |

| Net Interest Income | 2,593 | 2,740 | 2,559 | 29,170 | 28,468 |

| Non-interest Income | 10,317 | 4,744 | 5,546 | 13,402 | 12,231 |

| Net Operating Income | 12,910 | 7,484 | 8,105 | 42,572 | 40,699 |

| Other Operating Expenses | 2,910 | 3,034 | 3,019 | 20,836 | 21,025 |

| Expected Credit Loss/Impairment Loss of Loans and Debt Securities (Reversal) | 595 | (316) | 302 | 6,236 | 6,210 |

| Profit before Income Tax | 9,405 | 4,766 | 4,784 | 15,500 | 13,464 |

| Income Tax | 1,557 | 1,367 | 927 | 1,159 | 853 |

| Profit for the Year from Continuing Operations | 7,848 | 3,399 | 3,857 | 14,341 | 12,611 |

| Profit for the Year from Discontiued Operations | - | 13,361 | 11,949 | - | - |

| Profit for the Year | 7,848 | 16,760 | 15,806 | 14,341 | 12,611 |

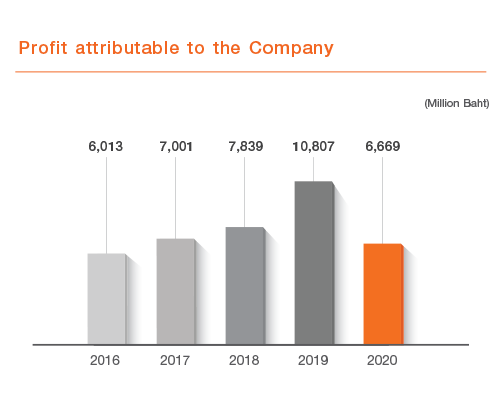

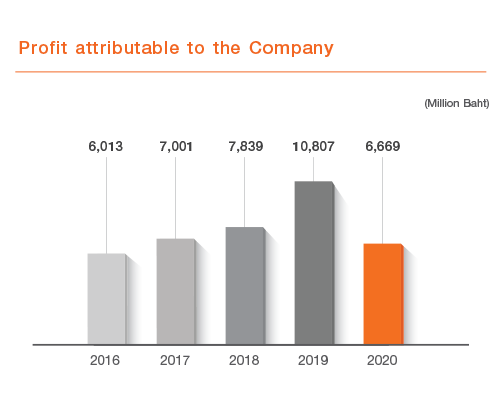

| Net Profit of the Company | 6,669 | 10,807 | 7,839 | 7,001 | 6,013 |

| Net Profit of Non-controlling Interest | 1,179 | 5,953 | 7,967 | 7,340 | 6,598 |

| Operating Performance Ratio (Percent) | |||||

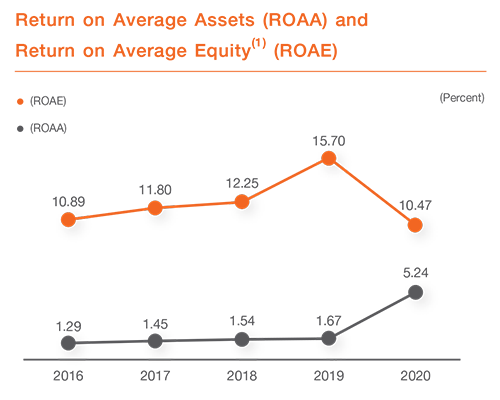

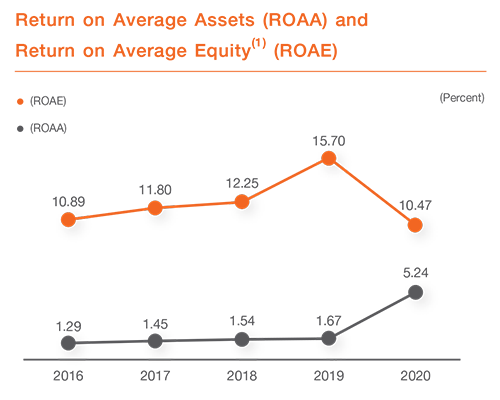

| Return on Average Assets (ROAA) | 5.24 | 1.67 | 1.54 | 1.45 | 1.29 |

| Return on Average Equity (1) (ROAE) | 10.47 | 15.70 | 12.25 | 11.80 | 10.89 |

| Debt to Equity Ratio (D/E Ratio) (times) | 0.93 | 1.17 | 6.69 | 6.88 | 7.07 |

| Financial Position (Million Baht) | |||||

| Loans to Customers and Accrued Interest Receivables - net | 50,251 | 53,159 | 731,125 | 688,844 | 667,522 |

| Total Assets | 140,756 | 160,927 | 1,060,929 | 1,025,525 | 966,867 |

| Total Liabilities | 67,987 | 86,868 | 923,011 | 895,455 | 847,016 |

| Total Equity | 72,769 | 74,059 | 137,918 | 130,070 | 119,851 |

| Equity Attributable to Owners of the Company | 63,311 | 65,833 | 65,735 | 62,020 | 56,891 |

| Common Share Information | |||||

| Information per Share (Baht) | |||||

| Basic Earnings per Share | 6.26 | 9.43 | 6.74 | 6.01 | 5.16 |

| Book Value | 60.38 | 57.46 | 57.15 | 53.23 | 48.83 |

| Dividends (2) | 1.20 | 7.00 | 2.60 | 2.20 | 2.00 |

| Common Shares Outstanding (Million Share) | |||||

| Average-Basic | 1,066 | 1,146 | 1,164 | 1,165 | 1,165 |

| End of Year | 1,049 | 1,146 | 1,150 | 1,165 | 1,165 |

| Share Price (3) (Baht) | |||||

| High | 57.00 | 59.50 | 60.25 | 58.00 | 44.75 |

| Low | 27.00 | 50.25 | 46.25 | 43.75 | 33.00 |

| Close | 34.50 | 53.50 | 49.75 | 56.25 | 44.00 |

| Market Capitalization (Million Baht) | 40,197 | 62,334 | 57,965 | 65,539 | 51,266 |

| Other Information | |||||

| Employees (4) | 1,864 | 2,062 | 13,893 | 13,885 | 14,763 |

Notes

(1) ROAE is calculated from equity attributable to owners of the Company

(2) Dividend per share for 2020 is interim rate paid and Dividend per share for 2019 is interim rate paid plus special interim rate paid

(3) Local Board / Highest and Lowest Share Prices During the Year

(4) Number of employees in 2020 and 2019 excludes employees of TBANK, TFUND, and TBROKE